All About Hard Money Georgia

Wiki Article

Rumored Buzz on Hard Money Georgia

Table of ContentsHard Money Georgia Things To Know Before You Get ThisThe Basic Principles Of Hard Money Georgia The Greatest Guide To Hard Money GeorgiaHard Money Georgia for Dummies

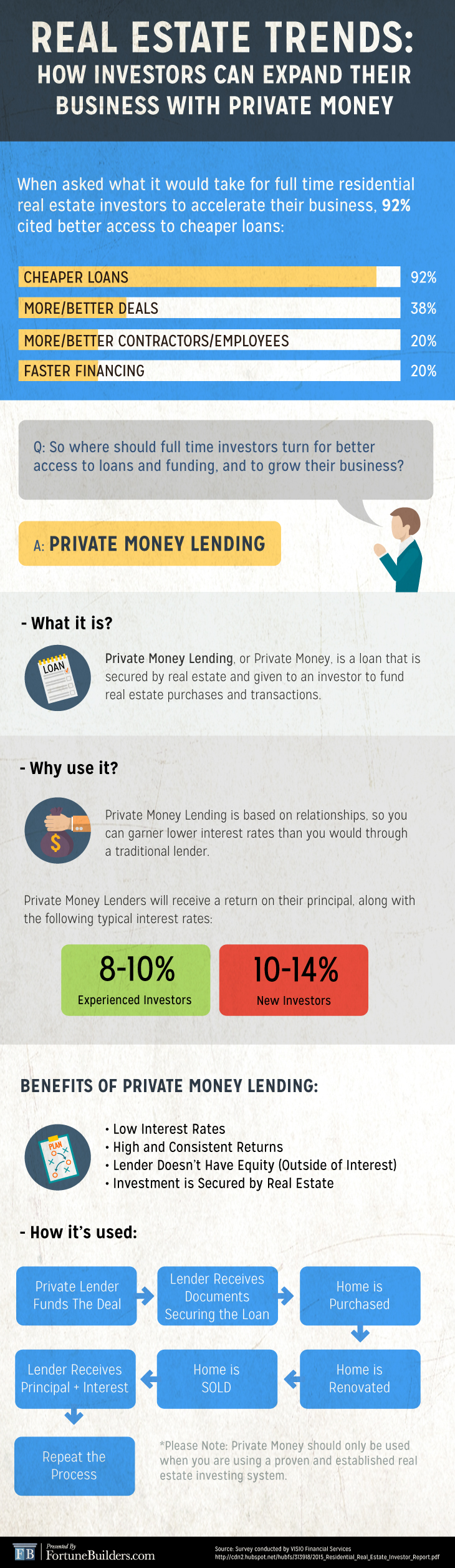

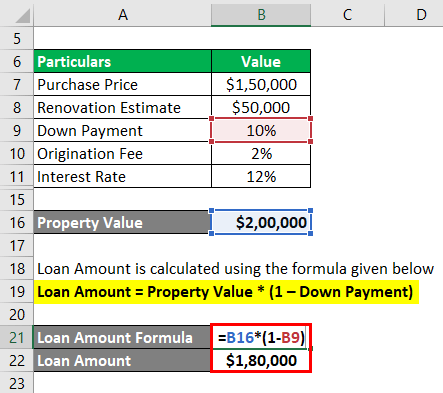

The optimum acceptable LTV for a difficult cash funding is commonly 65% to 75%. That's just how much of the property's expense the lending institution will certainly agree to cover. On a $200,000 house, the optimum a tough cash loan provider would certainly be willing to offer you is $150,000. To acquire the building, you'll need to create a down settlement large sufficient to cover the remainder of the acquisition price.You can receive a tough cash financing faster than with a typical home loan lending institution, and the bargain can enclose a matter of days. You'll pay a costs for that convenience. Tough cash lendings have a tendency to have higher rate of interest than typical mortgages. As of January 2020, the typical interest rate on a 30-year fixed-rate home loan was 3.

By comparison, passion rates on tough cash car loans begin at 6. Tough money loan providers often bill points on your loan, in some cases referred to as source costs.

Points are typically 2% to 3% of the financing quantity. 3 factors on a $200,000 lending would certainly be 3%, or $6,000.

Hard Money Georgia for Beginners

You can expect to pay anywhere from $500 to $2,500 in underwriting costs. Some hard money loan providers also charge prepayment penalties, as they make their money off the interest charges you pay them. That implies if you settle the finance early, you may need to pay an additional cost, adding to the finance's cost.

This suggests you're most likely to be provided funding than if you looked for a standard home loan with a questionable or slim credit report. If you need cash quickly for remodellings to turn a residence for profit, a difficult cash car loan can give you the cash you need without the headache as well as documentation of a traditional home mortgage.

It's a technique financiers utilize to acquire financial investments such as rental homes without using a lot of their own possessions, as well as tough money can be useful in these situations. Difficult cash car loans can be helpful for genuine estate financiers, they ought to be utilized with caution especially if you're a beginner to genuine estate investing.

If you default on your lending payments with a hard cash loan provider, the consequences can be severe. Some fundings are directly ensured so it can damage your credit score.

About Hard Money Georgia

To discover a credible lender, talk wikipedia reference to relied on genuine estate agents or mortgage brokers. They might be able to refer you to lending institutions they have actually collaborated with in the past. Tough money lending institutions likewise commonly attend investor conferences to make sure that can be a good area to attach with lenders near you.company website Equity is the value of the home minus what you still owe on the home loan. Like difficult cash finances, residence equity loans are protected financial debt, which indicates your residential property serves as collateral. The underwriting for home equity loans also takes your credit history as well as income right into account so they tend to have lower interest rates and also longer repayment periods.

:max_bytes(150000):strip_icc()/hard-money-soft-money_final-0223d3d452a049dc95a8a05b20c9142a.png)

It can also be labelled an asset-based loan or a STABBL finance (short-term asset-backed bridge funding) or a bridge funding. These are derived from its characteristic short-term nature and linked here also the demand for concrete, physical collateral, generally in the form of actual estate residential property.

The Single Strategy To Use For Hard Money Georgia

They are considered as temporary bridge financings as well as the major use case for difficult money financings remains in genuine estate purchases. They are considered a "hard" money funding as a result of the physical possession the property building called for to secure the loan. On the occasion that a borrower defaults on the car loan, the lender gets the right to presume possession of the residential property in order to recoup the finance sum.

This is why they are primarily accessed by property business owners who would commonly need rapid funding in order to not lose out on hot possibilities. Additionally, the loan provider primarily takes into consideration the value of the asset or home to be bought instead than the consumer's individual money background such as credit history score or income.

A conventional or financial institution financing may take up to 45 days to shut while a hard money loan can be closed in 7 to 10 days, sometimes earlier. The ease and also speed that difficult cash car loans offer continue to be a significant driving force for why actual estate investors select to utilize them.

Report this wiki page